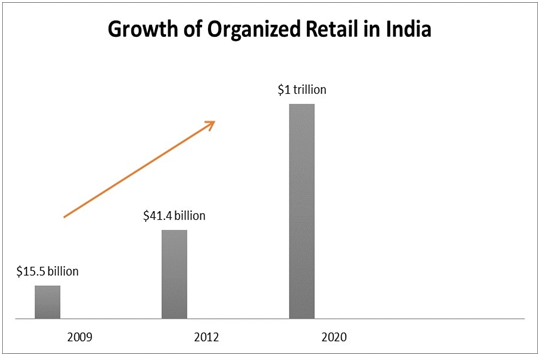

Currently India constitutes only 8% of organized retail and remaining 92% is left unorganized, which may grow much faster than traditional retail. It is expected to gain a higher share in the growing pie of the retail market in India. Various estimates put the share of organized retail as 20% by 2020.

India is well-known for its food and beverages service industry. It is one among the most vibrant industries which demonstrated unprecedented growth in the recent past. The industries is continues to expand rapidly. This growth can be attributed on account of changing demographics, growing disposable income, urbanization and growth of retail industry.

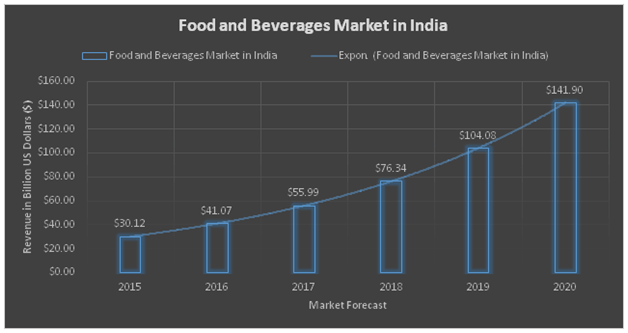

The food and beverage market was estimated at US$30.12 billion in 2015 and is expected to reach US$142 billion by 2020, with a compounded annual growth rate (CAGR) of 36.34%. The sector is dominated mainly by traditional operators. The brands and restaurant chains of both Indian origin and multinationals have not optimally penetrated the market so far. The food and beverage sector has evolved over the past decade, giving rise to exciting new concepts in food and beverage offerings and new and innovative service elements.

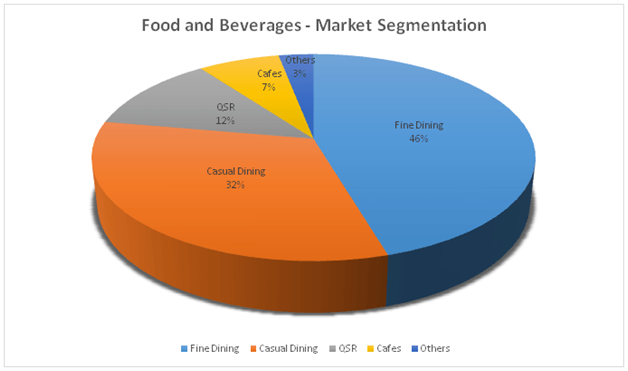

The food and beverages service market is dominated by unorganized segment and although it will decline significantly over the next 4-5 years, and it is likely to remain more than 60% of the market. Quick Service Restaurants (QSR) and casual dining are the two most popular formats that form 45% and 32% of the overall market respectively. The maximum growth being witnessed is still in the standalone restaurant space where local taste along with uniqueness of concept is the key deciding factor.

There is a wide acceptance for the segments like fine dining, casual dining, quick service restaurants, cafes in the recent past.

With investments expected both for expansion and by new entrants, there will also be a rapid development of the entire value chain in India. With emphasis on ‘Make in India’, it is expected that the major international players for kitchen equipment and processed food will set-up units in India to supply to this sector. In addition, there will be several domestic entrepreneurs who will make investments to increase quality levels and standards to meet the requirements of the sector.

The fitness industry in India is controlled at a variation point, with the high market division, amazing market potential and end-to-end overall growth. Several new business ideas are coming-up to disrupt this industry.The fitness sector in India has travelled a long journey from local ‘akhadas’ to wrestling now being a part of the international Olympics, with India actively taking part in it and winning medals for the country.

Bodybuilding and powerlifting championships are other such examples. Social occasions made people travel huge distances and perform for hours together, which in turn required exceptionally higher levels of stamina and strength. Today fitness industry in India is going towards health, well-being, good looks and confidence. Resistance training, aerobics, Zumba, aerial yoga, Pilates, MMA, kickboxing etc. have become the fitness trends over a few years in India.

The Indian fitness industry is going through a revolution spiked by the increasing number of cases of obesity and diabetes. If you look around, you will find that weight loss advertisements are everywhere. This is one of the reasons why health clubs and gym memberships are increasing. Spending on gym was earlier seen as a luxury, but now it is a way of life. Also in tier 2, tier 3 cities, people are increasingly going for wellness and fitness. Today’s generation wants to look and feel good at any cost and this is further fueling the overall growth of the fitness resources and services.

Big fitness chains and gyms are already expanding their product and services to tap into the market in each and every way possible and reach out to potential customers. Given the various and messy Indian market, franchising has caught on really fast.

Modern fitness concepts have entered India. The whole industry and the government should come together and catapult the industry to a stage where it can flourish. The fitness industry has great potential in a country like India. It is a sunrise sector, poised to grow by 22-30 per cent year on year.

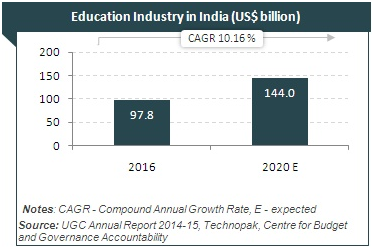

India holds an important place in the global education industry. The country has more than 1.5 million schools with over 260 million students enrolled and about 751 universities and 35,539 colleges. India has one of the largest higher education systems in the world. Around 35.7 million students were enrolled in higher education in India during 2016-17. However, there is still a lot of potential for further development in the education system.

India has become the second largest market for e-learning after the US. The sector is currently pegged at US$ 2 billion and is expected to reach US$ 5.7 billion by 2020. The distance education market in India is expected to grow at a Compound Annual Growth Rate (CAGR) of around 11 per cent# during 2016-2020. Moreover, the aim of the government to raise its current gross enrolment ratio to 30 per cent by 2020 will also boost the growth of the distance education in India. The total amount of Foreign Direct Investments (FDI) inflow into the education sector in India stood at US$ 1.67 billion from April 2000 to December 2017, according to data released by Department of Industrial Policy and Promotion (DIPP).

Education sector has seen a host of reforms and improved financial outlays in recent years that could possibly transform the country into a knowledge haven. With human resource increasingly gaining significance in the overall development of the country, development of education infrastructure is expected to remain the key focus in the current decade. In this scenario, infrastructure investment in the education sector is likely to see a considerable increase in the current decade

Moreover, availability of English speaking tech-educated talent, democratic governance and a strong legal and intellectual property protection framework are enablers for world class product development

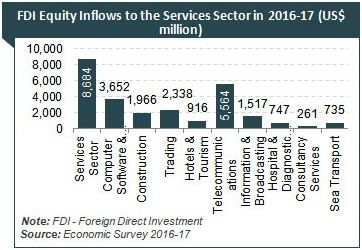

The services sector is not only the dominant sector in India’s GDP, but has also attracted significant foreign investment flows, contributed significantly to exports as well as provided large-scale employment. India’s services sector covers a wide variety of activities such as trade, hotel and restaurants, transport, storage and communication, financing, insurance, real estate, business services, community, social and personal services, and services associated with construction.

The services sector is the key driver of India’s economic growth. The sector is estimated to contribute around 54.0 per cent of India’s Gross Value Added in 2017-18 and employed 28.6 per cent of the total population. India’s net services exports during reached US$ 57.60 billion April-December 2017.

Services sector growth is governed by both domestic and global factors. The Indian facilities management market is expected to grow at 17 per cent CAGR between 2015 and 2020 and surpass the US$19 billion mark supported by booming real estate, retail, and hospitality sectors. The performance of trade, hotels and restaurants, and transport, storage and communication sectors are expected to improve in FY17. The financing, insurance, real estate, and business services sectors are also expected to continue their good run in FY17.

The implementation of the Goods and Services Tax (GST) has created a common national market and reduced the overall tax burden on goods. It is expected to reduce costs in the long run on account of availability of GST input credit, which will result in the reduction in prices of services

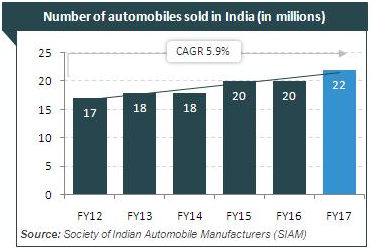

The Indian auto industry is one of the largest in the world. The industry accounts for 7.1 per cent of the country's Gross Domestic Product (GDP). The Two Wheelers segment with 80 per cent market share is the leader of the Indian Automobile market owing to a growing middle class and a young population.

Production of passenger vehicles, commercial vehicles, three wheelers and two wheelers grew at 14.41 per cent year-on-year between April-February 2017-18 to 26,402,671 vehicles.

The Government of India encourages foreign investment in the automobile sector and allows 100 per cent FDI under the automatic route.

The automobile industry is supported by various factors such as availability of skilled labour at low cost, robust R&D centres and low cost steel production. The industry also provides great opportunities for investment and direct and indirect employment to skilled and unskilled labour. The Indian automotive aftermarket is estimated to grow at around 10-15 per cent to reach US$ 16.5 billion by 2021 from around US$ 7 billion in 2016. It has the potential to generate up to US$ 300 billion in annual revenue by 2026, create 65 million additional jobs and contribute over 12 per cent to India’s Gross Domestic Product